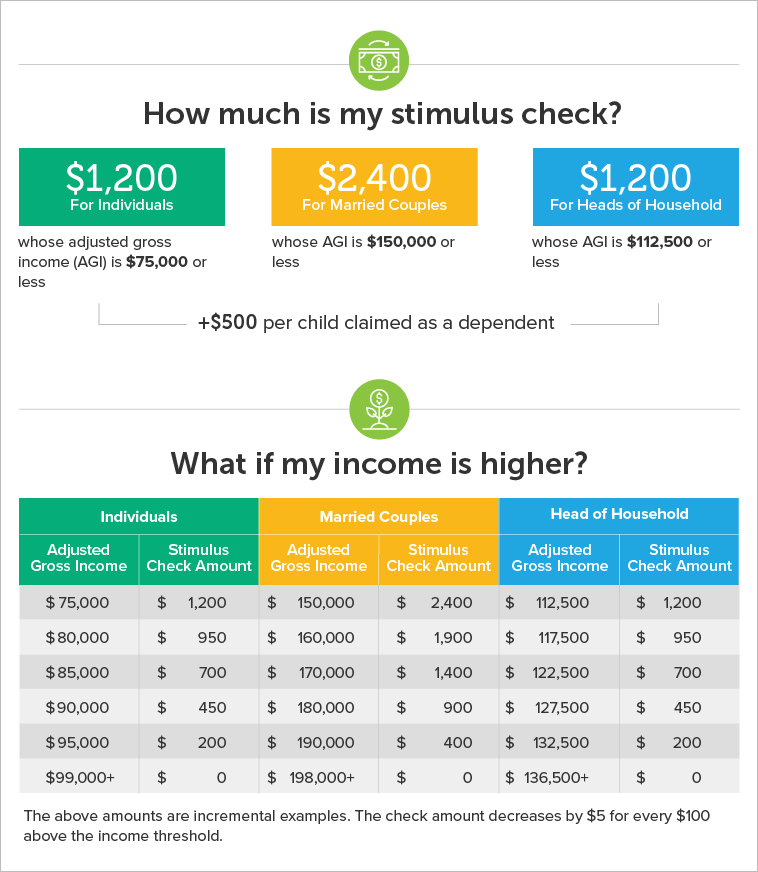

Am I Eligible For Stimulus Check 2025R 2025. Who qualifies for the new stimulus check? Those who did not file a 2021 tax return could still be eligible to receive the stimulus check if they file their 2021 return and claim the recovery rebate credit by april 15, 2025, the.

Who qualifies for the new stimulus check? To qualify for the 2025 stimulus check, individuals must meet specific adjusted gross income (agi) thresholds: Eligibility for the new 2025 stimulus check depends on 2021 tax data.